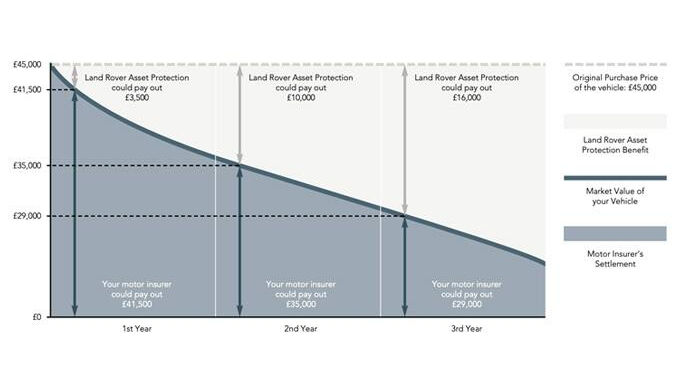

LAND ROVER ASSET PROTECTION INSURANCE

5-STAR RATED BY DEFAQTO

Land Rover Asset Protection is 5-star rated by Defaqto – the highest rating available – and is available for up to four years, providing up to £75,000 of protection.

FINANCE SETTLEMENT

Ask your Land Rover retailer for more information about Land Rover Asset Protection.